Every business needs capital and the more capital-intensive you are then the more you need to pay attention to how you obtain it.

Building a diverse capital stack is important as it allows you to maximise your opportunity for growth but at the same time reduce the cost of capital.

So what is a capital stack and how do you build one? In this article, we’ll tell you what a capital stack is, why you need one and how to build your own.

We will cover;

● What is a capital stack?

● The Risk/Reward/convenience balance

● What a typical capital stack looks like

● How to build your own capital stack

What is a capital stack?

If you are running a company then like it or not you have a capital stack. You may not know it but you have one!

A capital stack describes the different layers of capital that a company may use.

The name ‘stack’ is quite appropriate in that it describes a building-up process and can be used to illustrate the cost and size of each slice of the stack.

Most companies don’t pay a lot of attention to their capital stack and it builds rather haphazardly with little or no thought to the way that all of the different types fit together.

But planning out your capital stack and matching the type of capital with its use can pay real dividends.

The Risk/Reward/Convenience balance

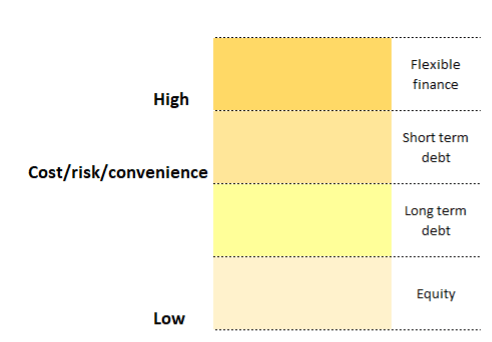

So when we think about capital we have to think about the features of the product or method we are using.

There are essentially three elements we need to consider; risk, reward and convenience.

The riskier you are as a company, the more expensive money is going to be.

If you are very secure then you’ll find that money is not only cheap but plentiful.

This is why experienced business owners always complain that the only time high street banks want to lend to them is when the company has lots of money in its account!

The risk-reward balance means that a lender that gives money to a company will expect a higher reward (in other words interest rate) if the company is risky.

Companies that are new or startups, have little in the way of assets and don’t have a secure income channel will find that their risk profile is high and their money is correspondingly expensive.

The third element that we need to think about is convenience.

If money is easy to get hold of, like overdrafts or credit cards then you can bet that it will be expensive. Conversely, if you have to jump through a load of hoops like providing cash flow forecasts and business plans then it will take longer to get the cash but the interest rate charged will be lower.

Loans secured on assets that are easily saleable like machinery and property will be cheaper than unsecured loans.

Finally, we have equity-type capital. With equity, no interest is charged but the risk/reward balance is achieved in a different way.

The more risky a company is the more control and rights an equity investor will expect and the bigger the slice of the pie will need to be on exit.

What a typical capital stack looks like

What a typical capital stack looks like

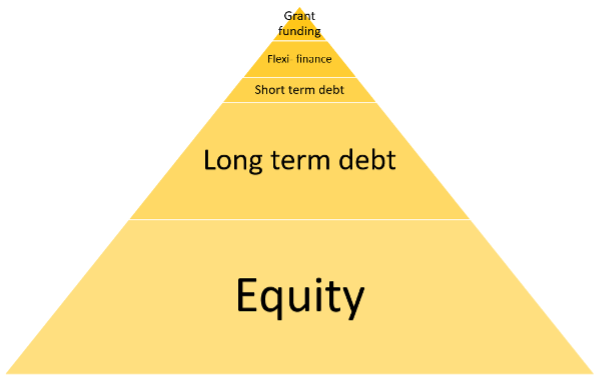

A good finance stack will feature a series of different sources of capital.

The owners of the company will mix equity with debt finance, short-term sources with long-term sources.

The aim will be to provide the optimum mix of flexibility and low cost.

Although the above graphic does a good job of showing the cost/convenience make-up of a typical capital stack we do have to remember

that actually different sources will be used in differing amounts.

In an ideal world, equity will form the largest part of a company’s capital stack, whether that is from introduced capital from owners or investors or from equity earned organically.

Of course, we don’t live in an ideal world so it is important to note that a capital stack can vary between industries and business types.

Whilst we have been talking about a capital stack in terms of the overall company it is also important to note that specific projects can have their own capital stack.

For a smaller project, such as buying a new CNC milling machine, it may not be expressed in formal terms.

But for larger projects like the development of a shopping centre, it is entirely possible that the owners will spend a good deal of time documenting where they expect the capital to come from to give confidence to their board and investors that they have the money required.

In the above graphic, we have also included grant funding. It is distinctly possible that this could form a large portion of a stack, especially in innovative projects that are aimed at providing benefits for the public such as medical research.

How to build your own capital stack

The starting point for building your own capital stack has to be to assess what your long-term plan is.

If you are wanting to be high-growth with an early exit then private equity or venture capital will be more important than debt finance.

At the same time, if you are raising capital for a specific project, say short-term innovative development, then you can look at flexible debt finance that is particularly suited to your situation.

By mapping out the reasons you need the finance you can match the types you need and then look for sources.

Remember of course that you can build separate stacks for specific projects or have a company or group stack.

The source you get your capital from is also important. It is vital that you find funders that understand your business and share your passion otherwise there could be problems in the future.

This is arguably one of the reasons why high-street bank finance is often so unsatisfactory for many companies.

Next Steps

As we mentioned above, one of the key steps in building a capital stack is to find a variety of funders who really understand the business you are in.

Here at Rocking Horse, we developed our innovative R&D tax credit finance product specifically to help companies that are doing innovative work and need a little help with their cash flow.

Call us now and let’s talk about how we can help you fund your projects.