Every year the British Business Bank (BBB) carries out a survey of the funding landscape for SMEs and this year’s iteration shows that some worrying trends are continuing.

For SMEs and the wider economy, capital availability is vital as it acts as the fuel in the engine of the economy.

Without access to plentiful and affordable finance companies and especially those engaged in innovative research and development can’t develop alongside their peers.

In this article, we take a look at some key points in what is a wide-ranging and very helpful report including;

● Who cares about SMEs?

● The challenges facing SMEs in 2023

● Lending volumes for SMEs in 2022

● Financing for innovation

Who cares about SMEs?

So what if SMEs can’t get hold of affordable finance – does it really matter?

SMEs employ more than 70% of the UK private sector workforce and no other sector is as good at quickly ramping up employment such as when we emerged out of lockdown. Over the last five years it is estimated that the SME sector has created over 2 million jobs.

SMEs make up 99% of businesses across every major sector and the UK government has identified that smaller companies can respond quickly to economic stimuli designed to improve the economy.

Added to the incredible flexibility and agility that SMEs exhibit, most of the true innovation comes from SMEs. Just think Starbucks, Uber or Lush and you’ll see a company that started as an SME and became a household name.

So we’d say that yes, a strong and healthy SNE sector is vital for a vibrant economy.

The challenges facing SMEs in 2023

So what challenges do SMEs face in 2023?

The broader economic picture doesn’t look good at all.

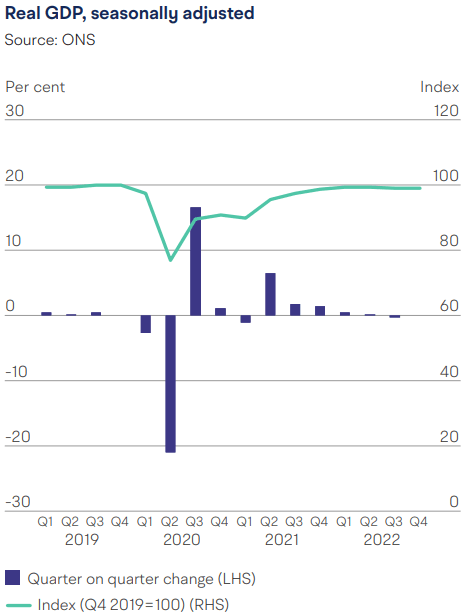

Whilst the UK economy has made back the GDP lost during the pandemic, other factors such as inflation, higher interest rates and the Ukraine war have dented consumer confidence.

In fact, GDP has even slipped back to a level below output before 2019.

This means that SMEs not only have to cope with the daily work of running their business but also the macroeconomic factors that depress demand.

Many companies also report that they are having post-Brexit problems with both exports and imports. The impact to the economy as a whole is estimated to be in the region of 5.5% but on a local scale many industries report severe problems with extra bureaucracy and red tape.

The twin issues of Brexit and the pandemic have also had an effect on the labour market with many businesses reporting difficulty in obtaining staff.

Lending volumes for SMEs in 2022

The lending picture is similarly mixed.

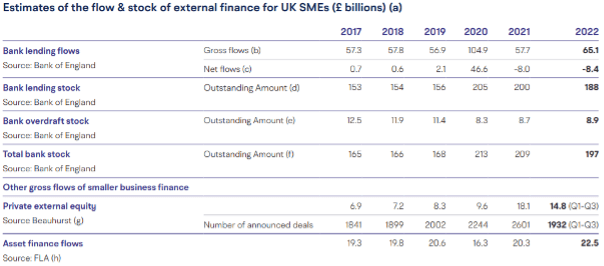

Following a large increase in bank lending during the bounceback loan scheme, bank loans are now more or less on-trend with £65m of outflows last year compared to £57.7m in 2021.

What is interesting is that the net picture sits at -£8.4m meaning that companies on the whole are choosing to pay down their existing facilities and not take on extra debt, possibly in response to higher interest rates.

Financing for innovation

Innovation finance is the sector we naturally gravitate towards in any report and the BBB report makes interesting reading here.

As many SMEs will know the Chancellor (now the Prime Minister) reduced the attractiveness of the R&D tax credit scheme in his last economic statement and critics claimed that this would depress innovation in the SME sector.

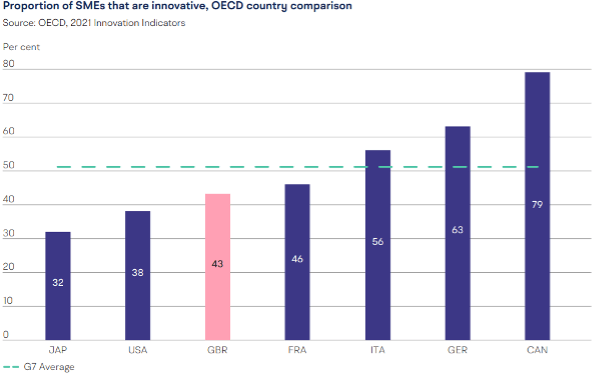

Sadly, the UK again lags behind other OECD developed nations and is well below the average. Admittedly the UK beats the US but that is cold comfort indeed and if we are to become a leading place to do business then we have to find a way to encourage innovative and original companies.

The largest group of companies carrying out innovative projects is in the 50-249 employee range but when looked at as a whole the SME sector is very active in this area.

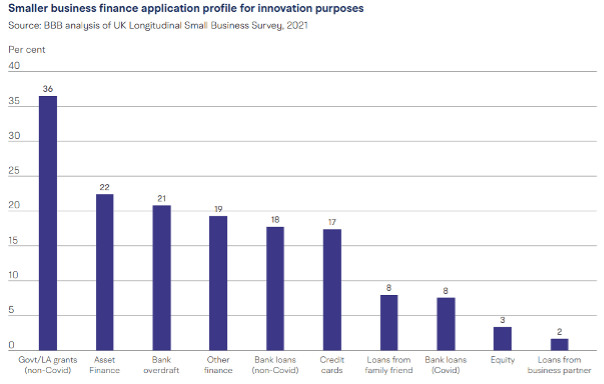

To finance projects smaller enterprises generally use a mixture of sources. The largest source of funds is government or grant applications and this perhaps points to the UK’s strength in science and pharma.

Traditional bank loans, asset finance and al;t-finance all sit at around 20% of funding applications and show that there are sources of finance for all occasions.

Interestingly smaller companies that were innovating tended to apply for at least three different sources of funds and on average are much more likely to0 apply for grant funding the large companies.

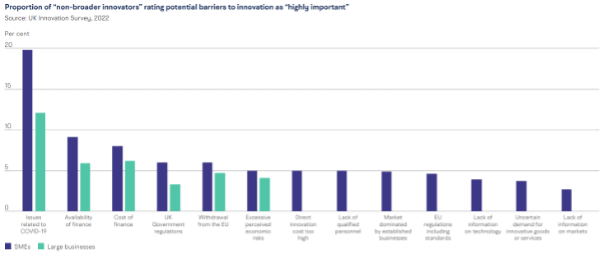

COVID though casts a long shadow and it is the top issue when it comes to growth. Second, however, is the availability of finance and the cost of this.

This suggests that innovative companies are still having difficulty sourcing funders, have to make more applications when they do and then experience high interest rates if loans are granted.

Overdraft finance is also an interesting highlight from the BBB report.

The stock of overdrafts has been trending upward for a few quarters but that trend has now been reversed for the first time since the pandemic. In addition, it is significantly below the pre-pandemic levels at £9bn compared to 2019s £12.2bn.

A very mixed picture for SMEs

It seems like every year we say that we are heading into a period of uncertainty but that is definitely true this year!

Higher interest rates, the Ukraine war dragging on, continuing Brexit issues and a forecast recession in the UK make it a tough place to do business, not least for SMEs.

But if there is one thing we have learned over the last decade or so is that when times are tough, SMEs are the ones to get us all out of the mess.

So although finance is tighter and many companies are drawing in their horns it is also true to say that a lot of innovative companies are working hard behind the scenes to turn things around.